- Home

- Companies

- Volstora B.V.

- Articles

- Myths & Challenges - Case Study

Myths & Challenges - Case Study

Analyzing the financial study of energy storage is an enormous task and contains significant risk. Solar panels have been demonstrated to perform reliably for decades and operate relatively simply with a one-directional flow of energy.

However energy storage has several deeper layers of operation that may be overcomplicated. Batteries remain electrochemical devices with bidirectional power flow, and a very different set of benefits and more complex off-takers. Also do not forget the shocking 75% failure rate in one public trial in Australia.

The purpose of this section is to demonstrate some of the tricks and pitfalls of energy storage financial analyses.

A quick definition of terms:

- Cyclelife – a cycle is a charge and discharge of a battery to a certain level known as the DOD.

- Degradation – the process by which usable capacity of a battery is permanently lost.

- DOD – depth of discharge, or the level to which a battery is discharged.

- EV – electric vehicle

- LFP (or LiFePO4) – a popular type of chemistry known as Lithium Phosphate or Lithium Iron Phosphate.

- Li-ion – this is a broad class of batteries that contain lithium which includes LFP, NCA, and several other types of chemistry.

- NCA – Nickel-cobalt-aluminum battery, a type of Li-ion battery that is very energy dense and flammable.

Conclusion

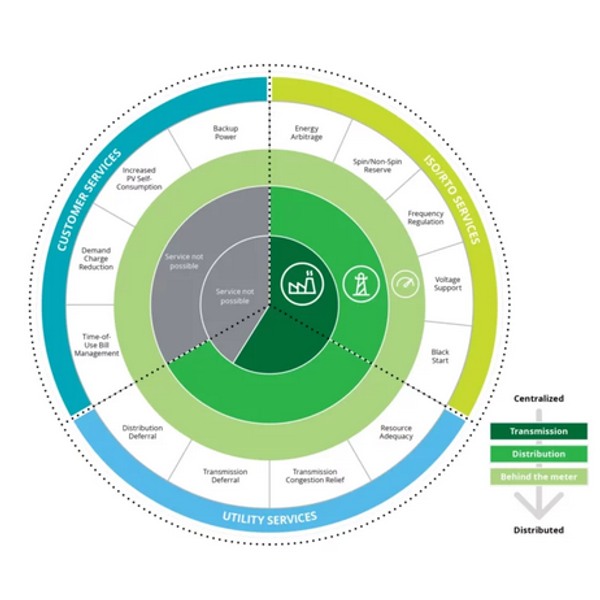

With such a wide array of revenue streams of energy storage, it is important to have a flexible and upgradeable system that can adapt to changing business cases and service requirements to avoid becoming obsolete. Volstora is aware of the developments in energy storage and so keeps an open-source software model built on top of a high performance system to allow limitless flexibility in the future. Please read our other info articles regarding the financial toolkit for comparing energy storage.