- Home

- Companies

- Montel Group

- Services

- Price Simulations Services

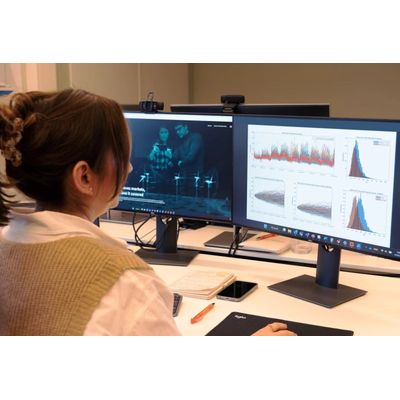

Price Simulations Services

Price simulations across gas, electricity, coal, CO2, spot & futures markets help you make the most of your commodity hedging. Select a ready made simulation or create something new with our energy derivatives price risk management tools.

Our monte carlo simulations enable users to optimise their commodity price risk management on a reliable and consistent basis. This is done by running multiple scenarios to find the price of commodities at defined points along a time curve.

They can also be used for state-of-the-art pricing of energy flexibility - enabling portfolio managers to accurately manage generation assets able to alter their production levels.

Preset simulation 1

5000 paths for correlated spot prices with the legs of dark and clean spark spreads.

Available for power, gas, CO2 & coal.

5000 paths for correlated futures prices over the next 5 Calendar years with the legs of dark and clean spark spreads.

Available for power, gas, CO2 & coal.

5000 paths for correlated futures prices for the next 5 years of quarterly delivery with the legs of dark and clean spark spreads.

Available for power, gas, CO2 & coal.

5000 paths for correlated futures prices for the next 5 years of monthly delivery with the legs of dark and clean spark spreads.

Available for power, gas, CO2 & coal.

Make your own simulation

Set your parameters for price simulations you want to see. Tell us what you need and we will support you in finding the right solution.